Zerodha is a India’s no.1 stock broker with more than 8,50,0000 + active customers. Just started in 2010 and Zerodha is suitable for all types of traders & investors, it leads the industry in Indian trading and low-cost commissions. Founded nearly 10 years ago, Zerodha securities is known for its industry-leading commissions schedule, margin rates, and customer care support & Trading platforms. In this post we are show you step-by-step zerodha brokerage calculation.

Recently they won award “Zerodha – India’s best retail brokerage for 2018” by NSE. Zerodha provides service in all segments like Equity, Currency, Commodity, F&O, Mutual fund etc. Zerodha only focus on execution of trades and trading platform offers by them is international standards.

Zerodha Brokerage Charges

| Segments | Brokerage Charges |

|---|---|

| Equity Intraday | ₹ 20 or 0.03% (whichever is lower) per executed order on intraday trades |

| Equity Delivery | ₹ 0 brokerage for All equity delivery (NSE, BSE) |

| Equity Future | ₹ 20 or 0.03% (whichever is lower) per executed order |

| Equity Option | ₹20 or 0.03% (whichever is lower) per executed order |

| Currency | ₹ 20 or 0.03% (whichever is lower) per executed order |

| Commodity | ₹ 20 or 0.03% (whichever is lower) per executed order |

| Mutual Fund | ₹ 0 commissions & DP charges Direct mutual fund buying |

Zerodha Brokerage Calculation for Equity Intraday Trading

For Example: Mr. Raj Buy 1000 shares of wipro at Rs.500 and Sell 1000 shares at Rs. 505 in Same day (Intraday).

List of Government Taxes and Charges for Equity Intraday

- Brokerage Charges: ₹ 20 or 0.03% (whichever is lower)

- STT/CTT: 0.025% on the sell side

- Exchange Transaction Charges: NSE: 0.00325%, BSE: 0.003%

- GST: 18% on (brokerage + transaction charges)

- SEBI Charges: ₹5 / crore

Lets Do the Calculation

Brokerage Charges: Rs.40

- Buy-Side Brokerage: Rs.20

- Sell-Side Brokerage: Rs.20

Total Turnover: Rs. 10,05,000 (Buy-side + Sell-side)

- Buy-side Turnover: 1000(shares) * 500 (Value) = Rs.5,00,000

- Sell-side Turnover: 1000(Shares) * 505 (Value) = Rs.5,05,000

STT Total: Rs.126

- (5,05,000(Sell-side) * 0.025) / 100 = Rs.126

Exchange Transaction Charges: Rs.32.66

- (10,05,000 (Total Turnover) * 0.00325) / 100 = Rs. 32.66

GST: Rs.13.08

- (40 (brokerage) + 32.66 (transaction) * 18 / 100 = Rs. 13.08

SEBI Charges: Rs. 0.5

- If ₹5 / crore than It will 0.5 paise on Turnover of Rs.10,05,000

Total Tax and charges = RS. 212.24 (Brokerage + STT/CTT + Transaction + GST + SEBI Charges)

Zerodha Brokerage Calculation for Equity Delivery Investments

For Example: Mr. Raj Buy 1000 shares of wipro at Rs.500 and Sell 1000 shares at Rs. 505 on next day (Take Delivery).

List of Government Taxes and Charges for Equity Intraday

- Brokerage Charges: ₹ 0 Absolutely Free

- STT/CTT: 0.1% on buy & sell

- Exchange Transaction Charges: NSE: 0.00325%, BSE: 0.003%

- GST: 18% on (brokerage + transaction charges)

- SEBI Charges: ₹5 / crore

Lets Do the Calculation

Brokerage Charges: Rs.0

- Buy-Side Brokerage: Rs.0

- Sell-Side Brokerage: Rs.0

Total Turnover: Rs. 10,05,000 (Buy-side + Sell-side)

- Buy-side Turnover: 1000(shares) * 500 (Value) = Rs.5,00,000

- Sell-side Turnover: 1000(Shares) * 505 (Value) = Rs.5,05,000

STT Total: Rs.1005

- (10,05,000(Buy+sell Side) * 0.1) / 100 = Rs.1005

Exchange Transaction Charges: Rs.32.66

- (10,05,000 (Total Turnover) * 0.00325) / 100 = Rs. 32.66

GST: Rs.5.88

- (0 (brokerage) + 32.66 (transaction) * 18 / 100 = Rs. 5.88

SEBI Charges: Rs. 0.5

- If ₹5 / crore than It will 0.5 paise on Turnover of Rs.10,05,000

Total Tax and charges = RS. 1044.04 (Brokerage + STT/CTT + Transaction + GST + SEBI Charges)

Zerodha Brokerage Calculation for Equity Future Trading

For Example: Mr. Raj Buy 1 lot 1000 shares of wipro Future at Rs.500 and Sell 1 lot at Rs. 505.

List of Government Taxes and Charges for Equity Intraday

- Brokerage Charges: ₹ 20 or 0.03% (whichever is lower)

- STT/CTT: 0.01% on the sell side

- Exchange Transaction Charges: NSE: 0.0019%

- GST: 18% on (brokerage + transaction charges)

- SEBI Charges: ₹5 / crore

Lets Do the Calculation

Brokerage Charges: Rs.40

- Buy-Side Brokerage: Rs.20

- Sell-Side Brokerage: Rs.20

Total Turnover: Rs. 10,05,000 (Buy-side + Sell-side)

- Buy-side Turnover: 1000(shares) * 500 (Value) = Rs.5,00,000

- Sell-side Turnover: 1000(Shares) * 505 (Value) = Rs.5,05,000

STT Total: Rs.51

- (5,05,000(Sell-side) * 0.001) / 100 = Rs.51

Exchange Transaction Charges: Rs.19.01

- (10,05,000 (Total Turnover) * 0.0019) / 100 = Rs. 19.01

GST: Rs.10.64

- (40 (brokerage) + 19.01 (transaction) * 18 / 100 = Rs. 10.64

SEBI Charges: Rs. 0.5

- If ₹5 / crore than It will 0.5 paise on Turnover of Rs.10,05,000

Total Tax and charges = RS. 121.24 (Brokerage + STT/CTT + Transaction + GST + SEBI Charges)

Zerodha Brokerage Calculation for Equity Option Trading

For Example: Mr. Raj Buy l lot 1000 shares of wipro Option at premium of Rs.500 and Sell l lot at premium of Rs. 505

List of Government Taxes and Charges for Equity Intraday

- Brokerage Charges: ₹ 20 or 0.03% (whichever is lower)

- STT/CTT: 0.05% on sell side (on premium)

- Exchange Transaction Charges: NSE: 0.05% (on premium)

- GST: 18% on (brokerage + transaction charges)

- SEBI Charges: ₹5 / crore

Lets Do the Calculation

Brokerage Charges: Rs.40

- Buy-Side Brokerage: Rs.20

- Sell-Side Brokerage: Rs.20

Total Turnover: Rs. 10,05,000 (Buy-side + Sell-side)

- Buy-side Turnover: 1000(shares) * 500 (Value) = Rs.5,00,000

- Sell-side Turnover: 1000(Shares) * 505 (Value) = Rs.5,05,000

STT Total: Rs.253

- (5,05,000(Sell Premium) * 0.05) / 100 = Rs.253

Exchange Transaction Charges: Rs.502.50

- (10,05,000 (Total Turnover) * 0.05) / 100 = Rs. 502.50

GST: Rs.97.65

- (40 (brokerage) + 502.50 (transaction) * 18 / 100 = Rs. 97.65

SEBI Charges: Rs. 0.5

- If ₹5 / crore than It will 0.5 paise on Turnover of Rs.10,05,000

Total Tax and charges = RS. 893.65 (Brokerage + STT/CTT + Transaction + GST + SEBI Charges)

Brokerage Calculation for Currency Futures Trading

For Example: Mr. Raj Buy 1 Lot of 1000 units of USD/INR Future at Rs.50 and Sell 1 Lot at at Rs. 51

List of Government Taxes and Charges for Equity Intraday

- Brokerage Charges: ₹ 20 or 0.03% (whichever is lower)

- STT/CTT: NO STT

- Exchange Transaction Charges: NSE: 0.0009%, BSE: 0.00022%

- GST: 18% on (brokerage + transaction charges)

- SEBI Charges: ₹5 / crore

Lets Do the Calculation

Brokerage Charges: Rs.40

- Buy-Side Brokerage: Rs.20

- Sell-Side Brokerage: Rs.20

Total Turnover: Rs. 1,01,000 (Buy-side + Sell-side)

- Buy-side Turnover: 1 Lot * 50 (Value) = Rs.50,000

- Sell-side Turnover: 1 Lot * 51 (Value) = Rs.51,000

Exchange Transaction Charges: Rs.0.91

- (1,01,000 (Total Turnover) * 0.0009) / 100 = Rs. 0.91

GST: Rs.5.62

- (40 (brokerage) + 0.91 (transaction) * 18 / 100 = Rs. 5.62

SEBI Charges: Rs. 0.05

- If ₹5 / crore than It will 0.05 paise on Turnover of Rs.1,05,000

Total Tax and charges = RS. 36.88 (Brokerage + STT/CTT + Transaction + GST + SEBI Charges)

Brokerage Calculation for Currency Options Trading

For Example: Mr. Raj Buy 1 Lot of 1000 units of USD/INR in options. STRIKE PRICE at Rs.50 and Buy at Premium of Rs.20 per unit and sell at Premium of Rs.21 per unit.

List of Government Taxes and Charges for Equity Intraday

- Brokerage Charges: ₹ 20 or 0.03% (whichever is lower)

- STT/CTT: NO STT

- Exchange Transaction Charges: NSE: 0.0009%, BSE: 0.001%

- GST: 18% on (brokerage + transaction charges)

- SEBI Charges: ₹5 / crore

Lets Do the Calculation

Brokerage Charges: Rs.40

- Buy-Side Brokerage: Rs.20

- Sell-Side Brokerage: Rs.20

Total Turnover: Rs. 41000 (Buy-side + Sell-side)

- Buy-side Turnover: 1 Lot * 20 (Premium) = Rs.20,000

- Sell-side Turnover: 1 Lot * 21 (Premium) = Rs.21,000

Exchange Transaction Charges: Rs.14.35

- (41,000 (Total Turnover) * 0.035) / 100 = Rs. 14.35

GST: Rs.9.78

- (40 (brokerage) + 14.35 (transaction) * 18 / 100 = Rs. 9.78

SEBI Charges: Rs. 0.05

- If ₹5 / crore than It will 0.05 paise on Turnover of Rs.41,000

Total Tax and charges = RS. 64.15 (Brokerage + STT/CTT + Transaction + GST + SEBI Charges)

Also Read:

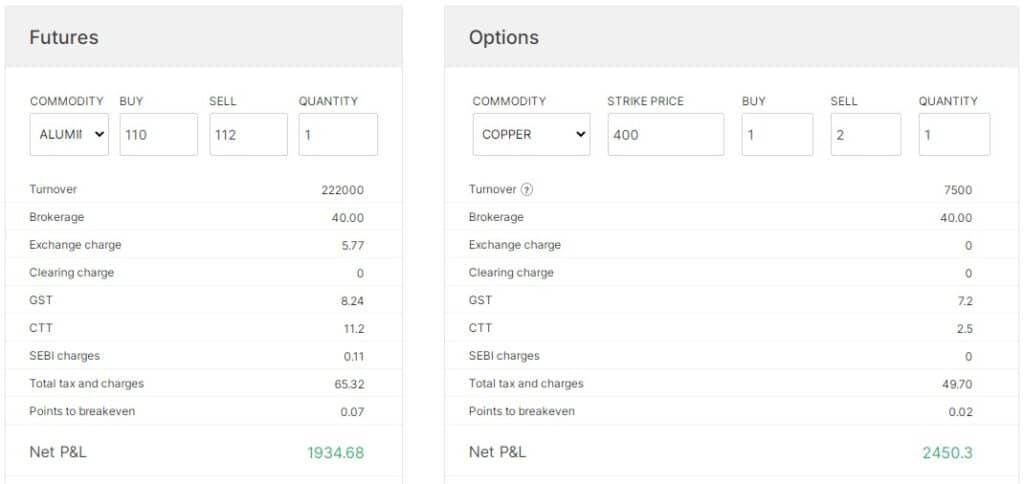

Brokerage Calculation Commodity Futures & Options Trading

List of Government Taxes and Charges for Equity Intraday

| Commodity Futures | Commodity Options | |

|---|---|---|

| Brokerage Charges | ₹ 0.03% or Rs. 20/executed order whichever is lower | 0.03% or Rs. 20/executed order whichever is lower |

| STT | 0.01% on sell side (Non-Agri) | 0.05% on sell side |

| Exchange Transaction Charges | Group A Exchange txn charge: 0.0026% * Far-month contracts: 0.0013% Group B: Exchange txn charge: CASTORSEED – 0.0005% KAPAS – 0.0005% PEPPER – 0.00005% RBDPMOLEIN – 0.001% | 0 |

| GST | 18% on (brokerage + transaction charges) | 18% on (brokerage + transaction charges) |

| SEBI Charges | Agri: ₹1 / crore Non-agri: ₹5 / crore | ₹5 / crore |

More Useful Article

on 01.11.21 I have bought 450 shares of Tata Motor @ Rs.45.5 and sold at Rs.46.Whether I am at ioss or gain,pl. explain after calculation of charges.

on 01.11.21 I had afund balance of Rs.47534.00,I bought 450 shares of Tata Motor at Rs.445.5 and soid these at Rs 446,my gain was Rs.225 as shown in trade position.After deduction of brokerage and taxes ,I expected a gain.But fund balance on today,02.11.21 is shown as RS 47406.80,a reduction of Rs.127.20.I am not able to understand whether I made a profit or loss on 01.11.21,from the report it seems clear that I made a loss of Rs.127.20.It will be highly appreciated,if I get a contract/trade note at the end of trading day in order to get a clear picture of my trading activitities of a particular day.Thanks.