In today’s world, every stockbroker gives full information about their brokerage fees as well as what fees are charged by the government in addition to the brokerage fees from their web site. At present, Exchange transaction charges, STT (Securities transaction tax), GST (Goods and Services Tax) , SEBI charges along with brokerage charges are levied immediately on every transaction.

If you can figure out how much brokerage fee will be charged along with other charges, you can understand before each transaction what price you can make a profit if the deal is completed. Below we provide detailed information on Angel Broking Brokerage Calculation with example for each market segments.

Angel Broking Brokerage Charges

| Segments | Brokerage Charges |

|---|---|

| Equity Intraday | Rs.20 per order |

| Equity Delivery | Rs.20 per order |

| Equity Future | Rs.20 per order |

| Equity Option | Rs.20 per order |

| Currency | Rs.20 per order |

| Commodity | Rs.20 per order |

Angel Broking Brokerage Calculation for Equity Intraday Trading

For Example: Mr. Aanand Buy 1000 shares of BPCL at Rs.200 and Sell 1000 shares at Rs. 205 in Same day (Intraday).

List of Government Taxes and Charges for Equity Intraday

- Brokerage Charges: ₹.20 per order

- STT/CTT: Delivery – 0.01% on both Sides & Intraday – 0.025% on Sell Side

- Exchange Transaction Charges: NSE: 0.00325%

- GST: 18% on (brokerage + transaction charges)

- SEBI Charges: ₹ 5 / crore

Lets Do the Calculation

Brokerage Charges: Rs.40

- Buy-Side Brokerage: Rs.20

- Sell-Side Brokerage: Rs.20

Total Turnover: Rs. 4,05,000 (Buy-side + Sell-side)

- Buy-side Turnover: 1000(shares) * 200 (Value) = Rs.2,00,000

- Sell-side Turnover: 1000(Shares) * 205 (Value) = Rs.2,05,000

STT Total: Rs.51.25

- (4,05,000(Sell-side) * 0.025) / 100 = Rs.51.25

Exchange Transaction Charges: Rs.11.44

- (4,05,000 (Total Turnover) * 0.00325) / 100 = Rs. 11.44

GST: Rs.9.20

- (40 (brokerage) + 11.44 (transaction) * 18 / 100 = Rs. 9.20

SEBI Charges: Rs. 0.41

- If ₹ 15 / crore than It will 0.41 paise on Turnover of Rs.4,05,000

Total Tax and charges = RS. 120.14 (Brokerage + STT/CTT + Transaction + GST + SEBI Charges+ State Stamp Dut)

Angel Broking Brokerage Calculation for Equity Delivery Investments

For Example: Mr. Aanand Buy 1000 shares of BPCL at Rs.200 and Sell 1000 shares at Rs. 205 on next day (Take Delivery).

List of Government Taxes and Charges for Equity Intraday

- Brokerage Charges: ₹ 0 Absolutely Free

- STT/CTT: 0.1% on buy & sell

- Exchange Transaction Charges: NSE: 0.00325%

- Demat transaction charges: Rs. 18.5 per scrip per day only on sell.

- GST: 18% on (brokerage + transaction charges)

- SEBI Charges: ₹ 5 / crore

Lets Do the Calculation

Brokerage Charges: Rs.0

- Buy-Side Brokerage: Rs.0

- Sell-Side Brokerage: Rs.0

Total Turnover: Rs. 4,05,000 (Buy-side + Sell-side)

- Buy-side Turnover: 1000(shares) * 200 (Value) = Rs.2,00,000

- Sell-side Turnover: 1000(Shares) * 205 (Value) = Rs.2,05,000

STT Total: Rs.405

- (4,05,000(Buy+sell Side) * 0.1) / 100 = Rs.405

Exchange Transaction Charges: Rs.11.14

- (4,05,000 (Total Turnover) * 0.00325) / 100 = Rs. 11.44

GST: Rs.2

- (0 (brokerage) + 11.44 (transaction) * 18 / 100 = Rs. 2

SEBI Charges: Rs. 0.41

- If ₹ 15 / crore than It will 0.41 paise on Turnover of Rs.04,05,000

Total Tax and charges = RS. 459.05 (Brokerage + STT/CTT + Transaction + GST + SEBI Charges+ State Stamp Duty)

Angel Broking Brokerage Calculation for Equity Future

For Example: Mr. Aanand Buy 1 lot 1000 shares of BPCL Future at Rs.200 and Sell 1 lot at Rs. 205.

List of Government Taxes and Charges for Equity Intraday

- Brokerage Charges: ₹ 20 or 0.05% (whichever is lower)

- STT/CTT: 0.01% on the sell side

- Exchange Transaction Charges: NSE: 0.0019%

- GST: 18% on (brokerage + transaction charges)

- SEBI Charges: ₹ 5 / crore

Lets Do the Calculation

Brokerage Charges: Rs.40

- Buy-Side Brokerage: Rs.20

- Sell-Side Brokerage: Rs.20

Total Turnover: Rs. 4,05,000 (Buy-side + Sell-side)

- Buy-side Turnover: 1000(shares) * 200 (Value) = Rs.2,00,000

- Sell-side Turnover: 1000(Shares) * 205 (Value) = Rs.2,05,000

STT Total: Rs.21

- (4,05,000(Sell-side) * 0.001) / 100 = Rs.51

Exchange Transaction Charges: Rs.21

- (04,05,000 (Total Turnover) * 0.0019) / 100 = Rs. 21

GST: Rs.8.59

- (40 (brokerage) + 21 (transaction) * 18 / 100 = Rs. 8.59

SEBI Charges: Rs. 0.60

- If ₹ 15 / crore than It will 0.60 paise on Turnover of Rs.4,05,000

Total Tax and charges = RS. 78.09 (Brokerage + STT/CTT + Transaction + GST + SEBI Charges)

Angel Broking Brokerage Calculation for Equity Option

For Example: Mr. Aanand Buy l lot 1000 shares of BPCL Option at premium of Rs.200 and Sell l lot at premium of Rs. 205

List of Government Taxes and Charges for Equity Intraday

- Brokerage Charges: ₹ 20 per order

- STT/CTT: 0.01% on sell side (on premium)

- Exchange Transaction Charges: NSE: 0.05% (on premium)

- GST: 18% on (brokerage + transaction charges)

- SEBI Charges: ₹5 / crore

Lets Do the Calculation

Brokerage Charges: Rs.40

- Buy-Side Brokerage: Rs.20

- Sell-Side Brokerage: Rs.20

Total Turnover: Rs. 4,05,000 (Buy-side + Sell-side)

- Buy-side Turnover: 1000(shares) * 200 (Value) = Rs.2,00,000

- Sell-side Turnover: 1000(Shares) * 205 (Value) = Rs2,05,000

STT Total: Rs.103

- (2,05,000(Sell Premium) * 0.05) / 100 = Rs.103

Exchange Transaction Charges: Rs.202.5

- (4,05,000 (Total Turnover) * 0.05) / 100 = Rs. 202.5

GST: Rs.43.65

- (40 (brokerage) + 202.5 (transaction) * 18 / 100 = Rs. 43.65

SEBI Charges: Rs. 0.60

- If ₹5 / crore than It will 0.5 paise on Turnover of Rs.04,05,000

Total Tax and charges = RS. 389.95 (Brokerage + STT/CTT + Transaction + GST + SEBI Charges)

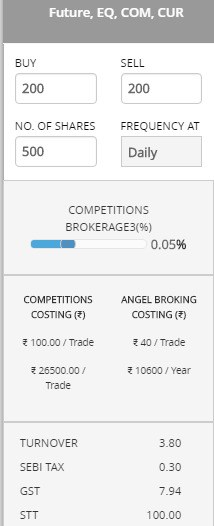

Brokerage Calculation for Currency Futures Trading

For Example: Mr. Suraj Buy 2 Lot of 1000 units of USD/INR Future at Rs.50 and Sell 2 Lot at at Rs. 51

List of Government Taxes and Charges for Equity Intraday

- Brokerage Charges: ₹ 20 per excited order

- STT/CTT: NO STT

- Exchange Transaction Charges: NSE: 0.0009%, BSE: 0.00022%

- GST: 18% on (brokerage + transaction charges)

- SEBI Charges: ₹ 5 / crore

Lets Do the Calculation

Brokerage Charges: Rs.40

- Buy-Side Brokerage: Rs.20

- Sell-Side Brokerage: Rs.20

Total Turnover: Rs. 2,02,000 (Buy-side + Sell-side)

- Buy-side Turnover: 2 Lot * 50 (Value) = Rs.1,00,000

- Sell-side Turnover: 2 Lot * 51 (Value) = Rs.1,02,000

Exchange Transaction Charges: Rs.1.82

- (2,02,000 (Total Turnover) * 0.0009) / 100 = Rs. 1.82

GST: Rs.7.53

- (40 (brokerage) + 1.82 (transaction) * 18 / 100 = Rs. 7.53

SEBI Charges: Rs. 0.30

- If ₹ 15 / crore than It will 0.30 paise on Turnover of Rs.2,02,000

Total Tax and charges = RS. 49.65 (Brokerage + STT/CTT + Transaction + GST + SEBI Charges)

Brokerage Calculation for Currency Options Trading

For Example: Mr. Aanand Buy 1 Lot of 1000 units of USD/INR in options. STRIKE PRICE at Rs.50 and Buy at Premium of Rs.20 per unit and sell at Premium of Rs.21 per unit.

List of Government Taxes and Charges for Equity Intraday

- Brokerage Charges: ₹ 20 or 0.03% (whichever is lower)

- STT/CTT: NO STT

- Exchange Transaction Charges: NSE: 0.0009%, BSE: 0.001%

- GST: 18% on (brokerage + transaction charges)

- SEBI Charges: ₹ 5 / crore

Lets Do the Calculation

Brokerage Charges: Rs.40

- Buy-Side Brokerage: Rs.20

- Sell-Side Brokerage: Rs.20

Total Turnover: Rs. 41000 (Buy-side + Sell-side)

- Buy-side Turnover: 1 Lot * 20 (Premium) = Rs.20,000

- Sell-side Turnover: 1 Lot * 21 (Premium) = Rs.21,000

Exchange Transaction Charges: Rs.14.35

- (41,000 (Total Turnover) * 0.035) / 100 = Rs. 14.35

GST: Rs.9.78

- (40 (brokerage) + 14.35 (transaction) * 18 / 100 = Rs. 9.78

SEBI Charges: Rs. 0.05

- If ₹5 / crore than It will 0.05 paise on Turnover of Rs.41,000

Total Tax and charges = RS. 64.15 (Brokerage + STT/CTT + Transaction + GST + SEBI Charges)

Also Read: Angel Broking Details Review

Brokerage Calculation Commodity Futures & Options Trading

List of Government Taxes and Charges for Equity Intraday

| Commodity Futures | Commodity Options | |

|---|---|---|

| Brokerage Charges | ₹ 0.05% or Rs. 20/executed order whichever is lower | 0.05% or Rs. 20/executed order whichever is lower |

| STT | 0.01% on sell side (Non-Agri) | 0.05% on sell side |

| Exchange Transaction Charges | Non-Agri: Exchange turnover charge: 0.0026% Clearing charge: 0.0005% | Exchange turnover charge: 0 Clearing charge: 0.002% on buy + sell [Rs. 200/crore] |

| GST | 18% on (brokerage + transaction charges) | 18% on (brokerage + transaction charges) |

| SEBI Charges | Rs. 5/crore | ₹ 5 / crore |

More Useful Article