Get the details & information related to Derivatives.

Introduction:-Derivatives is a product / Contract which does not have any value on its own It derives its value from an UNDERLYING ASSET

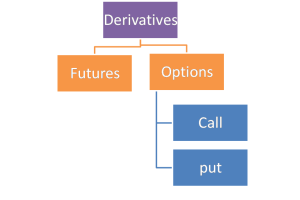

There Are Two Types of Derivatives Available.

1) Future

2) Option

Example:- Mr. Ganesh wants to buy 1000 shares of Wipro. Now he has two segments to trade this view cash market Derivative market Considering the buying price is to be Rs 200 & the target price to be Rs 300 & margin in futures to be 10%.

| Stratergy | Investment | Profit | Brokerage | Returns |

| Delivery | 2,00,000 | 1,00,000 | 0.50% | 50% |

| Futures | 20,000 | 1,00,000 | 0.10% | 500% |

Derivatives Product.

1.Futures.

2.options.

What Are Futures?

FUTURES CONTRACTS: It is an agreement or Contracts to Buy or Sell specified quantity of the underlying assets at price agreed upon by the Buyers & Selle, on or before a specified time.Both the Buyer & Seller are obligated to Buy / Sell the underlying asset.

TERMINOLOGIES (Futures Contract)

Contact Size: Quantity of the particular stock (Market lot).

Contract Month: Month when the contact Expires.

Contract Expiry: Last Thursday of every month.

Open interest: total outst&ing position in the market at any specific point in time.

Volume: No. of contracts traded.

Spot: Price in the cash market.

Margin: Deposit payable to take a position in Futures / Options Market.

RISK & RETURNS of Futures.

Risk n case of Futures contract is UNLIMITED for the Buyer as well as the seller.

Returns in case of Futures contract are also UNLIMITED for the Buyer as well as the Seller.

HOW DO YOU START?

BUILDING POSITION IN FUTURES

Mr. Ganesh wants to go Long in Wipro futures.

Rate in Futre Market —- Rs 200, Lot Size—1000 shares, Margin—10% (as per the volatility/exposure in the market).

Total investment:-Total value of trade = 1000*200 = Rs 2,00,000. Margin (Assuming 10%) of the total vlue of the trade = Rs 20,000.

TRANSACTION

DAY1.

Purchase Rate = 200.

Future Close = 220.

Credit = Rs. 20 (MTM*).

DAY2

Purchase Rate / Brought Forward Rate = 220.

Future Close / Carrid Forwrd Rate = 210.

Debit= Rs.10 (MTM*).

DAY3

Purchase Rate / Brought Forward Rate = 210.

Position Square Off = 215.

Credit = Rs 5 (Sq off).

Total Credit for the trade ——— Rs 15/-

*** Risk & Returns are Unlimited ***

What Did We Learn Form Futures?

Risk & Returns Profile is Same — Unlimited in both the cases. Investment in futures ( in the form of margin) I lower than the investment in case of buying delivery Daily monitoring of position is very important (as risk is unlimited & lot size is fixed).

For further reading:

More Useful Article