It is important to invest in the present in order to make a profit in the future. We now benefit from the investment made by our ancestors. It is very important to invest in the best place to get a good return. Sometimes you have little capital but don’t know where or how to invest it. Many questions come to mind. With the advice of others without any study, we invest in fraudulent schemes and incur huge losses.

Below is a list of the 15 most important things to consider before investing in a company.

1.Company Health

Carefully assure the business of the company, its scope, management, etc.

2.Company Financial Audit

The profitability of the company should be taken into account. It remains to be seen whether the company has maintained consistency in making profits for at least the previous five years. If there are any abnormalities in her profit-loss letter, such as a sudden increase in sales revenue, it should be treated if the other revenue increases.

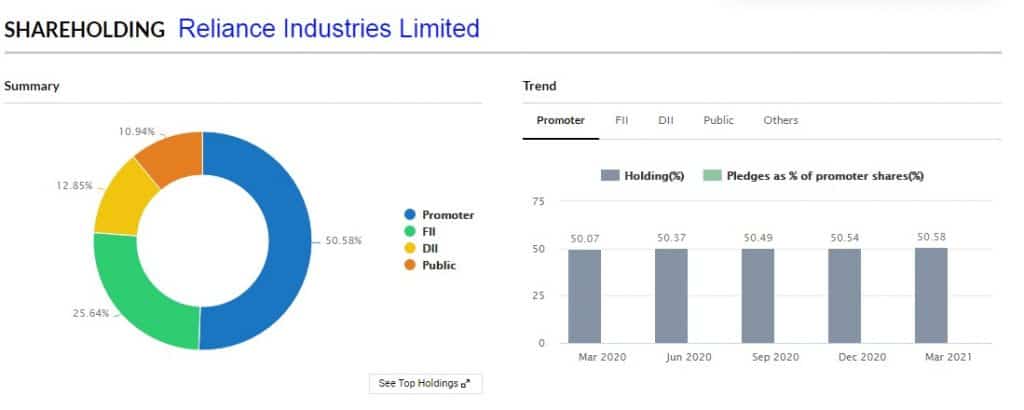

3.Major Shareholders

One of the most important thing is shareholders of company. Shareholders are those that hold a stake in a company. Brand value is very important part of any business. Big investor helps to create brand value of company.

4.Business Plan & Future Policies

Every business run on its unique idea & business strategy. Ideas that seem to be beneficial in the present times begin to fade over time. It is very important to know the future policy of the company.

5.Keep Track of Company News

If a company is listed on the stock exchange (NSE/BSE), its share price movements should be considered. Keep an eye on the news and developments related to her shares. E.g. The viability of a company is confirmed by a mutual fund scheme, investments made by a large institutional investor in the company, equity recommendations from reputed institutions, etc.

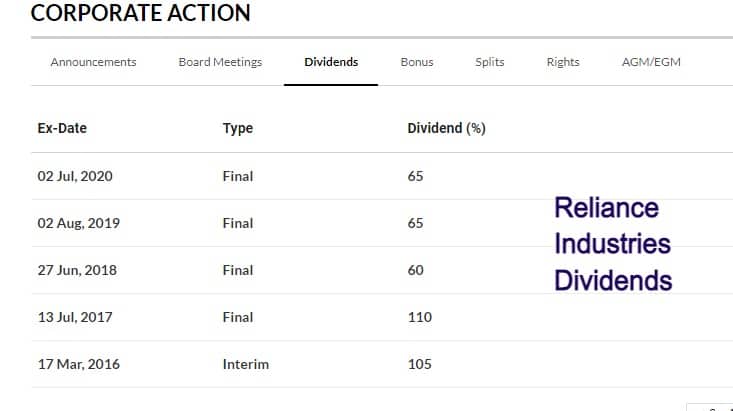

6.Dividends

Companies that do not pay regular dividends, Bonus to their shareholders should be wary of such companies.

7.Don’t Trap in Geed

The interest rate payable on company term deposits is definitely a bit higher in attracting investors as compared to banks and financial institutions. But in the current scenario, if any company promises to pay more than a reasonable interest rate of 15 per cent, it should be considered as black.

8.Regular Transparency

Companies should be selected for investment with established recognition and transparency in all matters, providing regular information to the stock exchanges about their business and financial affairs. So that it is easy and convenient to get information about the selected company.

9.Rules & Regulations of Scheme

Most companies have a fixed mandatory investment period (lock-in period) of 3 to 6 months for their deposits. Moreover, if the money is withdrawn before the prescribed time, a penalty is levied. The details mentioned in the plan proposal document must be taken into consideration before selecting.

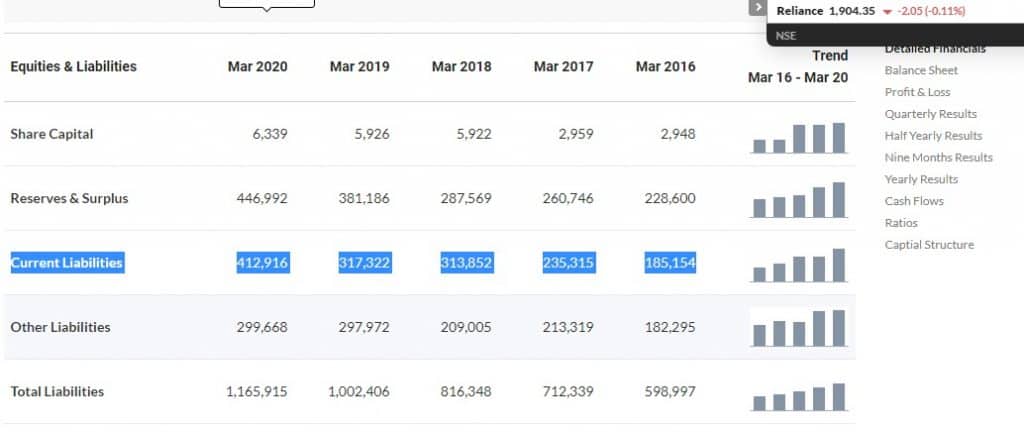

10.Debt on the Company

There should also be a look at the debt obligations on the company. If the amount of secured and unsecured loan taken exceeds the company’s net assets (equity + reserves), then it is considered high risk.

11.Debt Service Coverage Ratio

The debt service coverage ratio of the company you have chosen should also check the gross income of the company, divided by the loan repayment instalment (plus interest). If this number is 3 or more, fine. But if it is less than two, then such a company should be considered dangerous.

12.Diversification of Investments

Choosing more than one company would be more risk averse than investing all the money in the same company’s deposits.

13.Age Benefits

Some companies offer higher interest rates to older citizens. They offer 1 to 1.5% higher interests per annum than ordinary citizens. Investors should invest in a company with complete information and reputation. Don’t fall into any greed or Fraud scheme.

14.Duration of Investment

It is always advisable to make an investment decision on the advice of a Certified Financial Planner (CFP). Considering your risk-taking ability and risk factors in investing, expert planners will offer you a variety of stable and fixed income investment options suitable for achieving your financial goals.

15.Certified Financial Planner

Carefully read the footnote of the proposal document before investing. The security of the investment should always take precedence over the return on investment. Take risks depending on which of your financial goals is short, medium or long.

Take a Look