Technical analysis has become popular over the past several years, as more and more people believe that the historical performance of a stock is a strong indication of future performance. TA completely based on technical indicators Before we study technical indicators we need to know Technical Analysis Advantages and Disadvantages.

Technical analysis is a method of evaluating securities by analyzing statistics generated by market activity, past prices, and volume. Technical analysts do not attempt to measure a security’s intrinsic value; instead they look for patterns and indicators on stock charts that will determine a stocks future performance.

What is Technical Analysis?

Technical analysis is an art that helps you to invest/trade along with the direction of the trend and make the most of it. The approach is based on the demand/supply situation in the market. If the demand for the scrip/commodity is more than the supply the prices will rise and it would be prudent to buy. On the other hand if the supply of the commodity/ share is more than the demand the prices will fall and it would be prudent to exit i.e. sell or book profits.

Technical analysis can be defined as an art of identifying the trend reversal at a very early stage and to take position at the right time in the direction of the reversal to ride the trend until there is evidence enough to suggest that there will again be a change in trend.

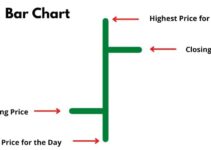

Prices can be monitored on a yearly, quarterly, monthly, daily, hourly, minute, and tick basis.

Advantages of Technical Analysis – Pros

- Incase of pure technical analysis, there is very little or no room for interpretation. Thus the system becomes Mechanical.

- Technical analysis helps traders and investors alike to review their investment decisions faster. This is because prices tend to discount, i.e. anticipate, fundamental information much before an actual event takes place.

- All results and indicators can be tested and verified historically.

- The advent of low-priced personal computer systems had made the use of technical analysis even less difficult to test and employ.

- Today no of technical analysis charting software are available which will help you to generate buy and sell signals for you.

- Technical analysis is considered to be a disciplined approach as it makes use of stop loss theory.

Disadvantages of Technical Analysis – Cons

- Technical Analysis is not a valid scientific approach because most methods study prices based upon price related data. Therefore it is necessary that a trader continuously review his trading systems to check its work ability.

- The basis of technical analysis may be easy to learn but rather difficult to implement and master.

- Most traders tend to oscillate between different approaches and thus fail to follow through with their analysis in a consistent manner, and this ultimately results into losses more often than profit.

Take a Look

Thanks For Describing Technical Analysis Course That Will Definitely Help To grow in The Stock Market