The question in the mind of every new beginner’s is how to choose best stocks? Shares with low prices are good or Shares with high prices are good? The answer is, good shares can be identified by the fundamentals of that company. Long-term investors always rely on the company’s fundamentals.

What Exactly is Fundamental?

Everything about a company’s business, turnover, profits, and company that is directly related to its share price is called fundamental. Whether the share price is right or low according to the performance of the company is known by the fundamentals.

What to Look for in Fundamentals?

Quarterly Results / Annual Results: Quarterly and annual results, total turnover, sales, pre-tax profit and after-tax profit. It should check the current results with the previous quarter and the same period of the previous year. This gives an idea of how the company is performing.

Price Earnings Ratio (PE): Earnings per share (EPS) is the PE ratio. The higher the ratio, the higher the share price. However, some companies run very well and the PE ratio is higher due to high demand for shares of such companies. If the demand for shares increases and it goes into the overbought zone (above the highest buying level) then the PE ratio looks higher. From here, things get trickier, and this is where the PE ratio comes in.

Earnings per share (EPS): The earnings per share of a company is represented by the earnings per share, the company’s total profit divided by the total shares minus the dividend amount, to put it simply, the higher the EPS, the higher the company’s profit. Now more profit means more demand for shares. This means even higher PE ratio.

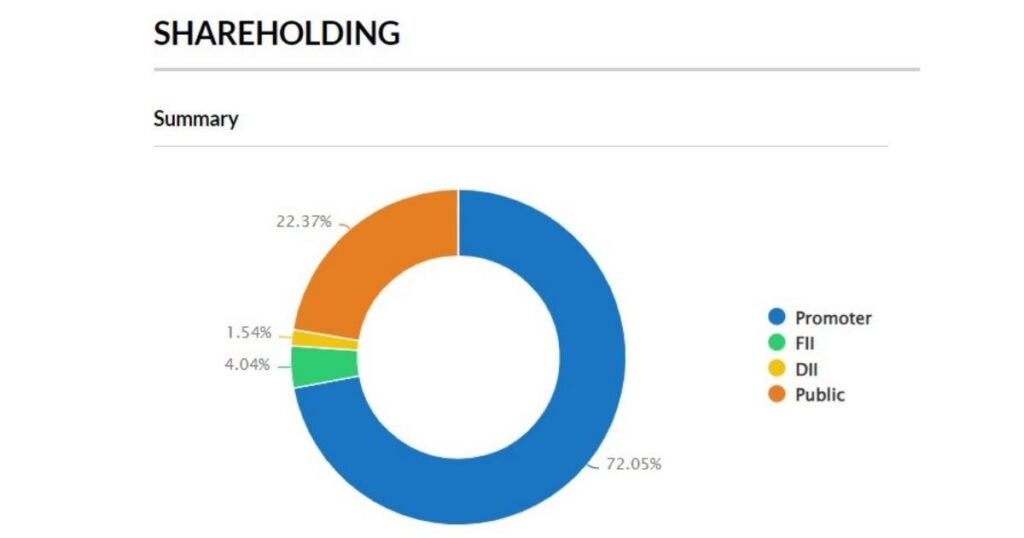

Share Holding Pattern: This is an important factor in fundamentals. It understands the company’s shareholders and their division. This pattern is as follows. Moneycontrol.com is best option for all this study.

- Promoters: The promoters of a company have the largest share.

- Foreign Investors: Foreign investors can invest in Indian companies. Let’s see exactly how much of their share.

- Mutual Funds: Mutual fund companies have market experts who invest in various companies through regular study. We see their share in the fundamental.

- Domestic Investors: Indian financial institutions and large investors are referred to as Domestic Investors. These companies invest money in many companies in the market.

- Insurance companies: Life insurance and all other types of companies invest directly in the stock market.

- Other Generals: Investors like you who are not institutions fall into this category. If there is a difference in this pattern at the quarterly and annual level, it becomes a guideline.

Conclusion

The above four factors are important in fundamentals among many other factors. By studying this, it is possible to make the right decision on whether to make a new investment or to withdraw the investment. Fundamentals are considered as an important troll for choosing good shares.

Take a Look