Achiievers Equities ltd company incorporated in 2010 A customer can trade in NSE, BSE, MCX, MCX-SX. also registered as a depository participant with a CDSL.

Provides Research & Tips to its customers, Brokerage Calculator. One of the most important things about Achiievers Equities ltd is very low brokerage plan.

The company has a Good reputation in India, offering very good customers support. They offer Product like EQUITY, DERIVATIVES, IPO, COMMODITIES, CURRENCY DERIVATIVES, MUTUAL FUNDS, INSURANCE, FIXED DEPOSITS, BROKING SERVICES, DISTRIBUTION SERVICES, GOLD LOAN Etc.

| Website. | achiieversequitiesltd.com |

| Demat Account. | CDSL. |

| Trading Exchanges. | NSE,BSE,MCX. |

| Broker Type. | Discount broker. |

Achiievers Equities Ltd Opening Fees & Charges.

| Trading Account. | Rs 750. |

| Demat account. | NA. |

| Commodity Account. | Rs 300. |

| Trading Annual maintenance charges (AMC). | Rs 400/year. |

Achiievers Equities Ltd Brokerage Charges.

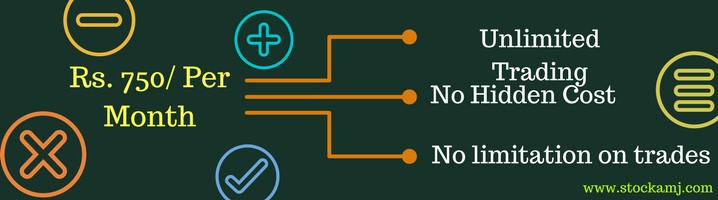

Unlimited Trade (Megha Value Plan):

- Unlimited Trading @ Rs 750/Month.

- Per Trade Plan Rs 15 Per Trade with 0% brokerage.

Achiievers Equities ltd Margins or Leverage.

| SEGMENT. | MARGINS. |

| Equity (Intraday). | Up to 5 times for Intraday. |

| Equity (Delivery). | 0 for Delivery. |

| Equity Futures. | Up to 2 times for Intraday. |

| Equity Options. | No extra Leverage. |

| Currency Futures. | No extra Leverage. |

| Currency Options. | Up to 2 times for Intraday. |

| Commodity. | Up to 4 times for Intraday. |

Achiievers Equities Ltd Trading Platforms or Software.

| Trading Platform or Software. | Available. |

| Web-based. | Available |

| Mobile Application. | NA. |

Achiievers Equities Ltd Some Useful Services.

| Online Trade Reports. | Available. |

| Online PNL Reports. | Available. |

| Intraday Chart Facility. | 5 Days. |

| End of Day Chart Facility. | 5 Years. |

| 3 in 1 Account. | Not available. |

| Instant Fund withdrawal. | Not available.. |

| Relationship Managers. | Available. |

Achiievers Equities Ltd Useful Details.

| Price (Broker Type). | Per Order or Unlimited Trading. |

| Headquarters City (Head Office). | Kolkata (West Bengal). |

| Total Branches (Presence). | 6 Branches. |

| Research & Tips. | YES Research & Tips. |

| Total Experience in Broking. | 16 Years of experience. |

| Year of Incorporation. | 1999. |

Client Info & NRI Account opining Regulations.

| Current Active Client Base? | More Than 11,000. |

| NRI Account Opening Allowed Or Not. | YES, It is Allowed. |

Fund Transfers Service.

| A number of banks linked to account. | 20+ |

| Mode of payment (Withdraw &Deposit). | Payment Gateway, NEFT/RTGS. |

| Fund Payin processing time. | Instant, NEFT/RTGS. |

| Fund Payout processed (Working Days). | 1 Day. |

Turnover & Other Charges.

| Equity (Cash & Delivery) Turnover charges. | As per Exchange. |

| Equity Futures Turnover charges. | 0.0039%. |

| Equity Options Turnover charges. | 0.075%. |

| Currency Futures Turnover charges. | As per Exchange. |

| Currency Options Turnover charges. | As per Exchange. |

| Commodities Turnover charges. | As per Exchange. |

| Dial & Trade charges. | Rs. 15 / per executed order. |

| DP Transaction charge. | 0.025% or Rs .5 whichever higher. |

Wait! Looking for Best Demat Account

FREE Investing in Stocks & Mutual Funds with No 1 broker in India!!

+1 Crore Happy Customers

Zero Brokerage on Equity Delivery Trades

Flat ₹20 or 0.03% (whichever is lower) for Intraday and F&O

Trade with the best platforms and tools

Support & Tools Available.

| Brokerage calculator. | Available. |

| Margin Calculator. | Not Available. |

| Bracket orders & Trailing stoploss. | Not Available. |

| Cover order. | Available. |

| User guide & remote end support. | Available. |

Reports & Confirmation.

| Contract notes on Email. | Yes (Register Email ID). |

| Contract notes online. | Yes (Register Email ID). |

| Periodical statement on Email. | Yes (Register Email ID). |

| Trade confirmation on Email. | Yes (Register Email ID). |

| Trade confirmation on SMS. | Yes (Register Email ID). |

Additional Features.

| Charting (Intraday & EOD). | Available |

| Coding or Backtesting (Algo Trading). | Available (Algo trading). |

| Referral program (Affiliate). | Available |

| Training & Education. | Not Available. |

| Online trading community. | Not Available. |

Achiievers Equities Ltd Customer Care Services Details.

| Contact Details. | Registered Office. 32/A Diamond Harbour Road, SakherBazar, Kolkata:700008. Phone:+913366063000. Fax:+913366063041. Toll-Free Number:18604203333. Corporate Office. 6thFloor, ICCHouse, 4IndiaExchangePlace, Dalhousie, Kolkata-700001. Phone:03366067900. |

| Call. | Customer Care, Centralized Service Helpdesk 033 66063000. Toll-Free No – 18604203333. |

| Email. | [email protected] |

| Complaints Or Grievances. | [email protected] |

Achiievers Equities Review & Ratings

On the scale of 5 (0 is worst & 5 is best). Below are the review & rating for Achiievers Equities.

| Summary | Ratings |

|---|---|

| Customer Experience | 3.5 / 5 |

| Trading Platform / Mobile APP | 4 / 5 |

| Services | 4 / 5 |

| Brokerage Charges | 5 / 5 |

| Fund Add / Withdrawal | 4.5 / 5 |

| Overall Rating | 4 / 5 |

| Star Rating | ★★★★ |

| Review Counts | 452 |

More Useful Article