Table of Contents

5paisa Discount Broker with Full-Service Benefits

5paisa Capital Ltd (NSE: 5PAISA, BSE: 540776) is a publicly listed discount stockbroker serving over 1.25 lakh active clients with a daily turnover of ₹15,000+ crore. Established in 2006, it is India’s only publicly traded discount broker and offers services in equity, F&O, currency, and mutual funds.

With a market cap of ₹400+ crore, stands among India’s top 20 brokers. It charges a flat fee of ₹10 per executed order and is popular for its affordable rates, strong customer support, and user-friendly trading platforms.

5Paisa Introduction

| Incorporation Year | 2005 |

| Broker Services | Full-service Discount Broker |

| Website URL | www.5paisa.com |

| Contact Number | +91 8976689766 |

| Exchanges Accessible | NSE, BSE, MCX-SX |

| Demat (NSDL/CDSL) | CDSL |

| Active Total Client | 10000+ Clients |

💼5paisa Brokerage Charges, Commission & Fees

Looking for a low-cost discount broker in India? Stands out with its simple, flat-rate brokerage structure and quality services. In this updated review, we dive into the latest brokerage charges, commissions, and fee structure offered by 5paisa Capital to help you decide if it’s the right platform for your investments.

Key Highlights

- Flat ₹10 per executed order across segments

- No hidden fees or account maintenance surprises ❌

- One of the most affordable platforms compared to Zerodha, Upstox, etc.

- Offers direct mutual fund investments with zero commission

- Includes tools, research reports, and educational content

5paisa Brokerage Charges

| Segment | Brokerage Fee |

|---|---|

| Equity Intraday | ₹10 per executed order |

| Equity Delivery | ₹10 per executed order |

| Equity Futures | ₹10 per executed order |

| Equity Options | ₹10 per executed order |

| Currency Futures | ₹10 per executed order |

| Currency Options | ₹10 per executed order |

| Commodity Trading | Not Available |

| Minimum Brokerage | Flat ₹10 |

| Call & Trade Charges | ₹100 per call (no order limit) |

| Hidden Charges | No ❌ |

How 5paisa Compares With Other Brokers

Compared to top brokers like Zerodha and Upstox (₹20 per order), nearly 50% cheaper per executed order. It initiated a pricing revolution in 2016, forcing full-service brokers to lower their rates across the board.

Value Beyond Low Brokerage

Unlike typical discount brokers that only focus on transactions:

- Stock research and advisory tools 📈

- News updates and trading alerts

- Educational articles and video tutorials

- Direct Mutual Fund investments (zero commission)

Subscription Plans

- Monthly Plan: ❌ Not Available

- Yearly Plan: ❌ Not Available

- Custom Plans: ❌ Not Available

⚖️5paisa Margin & Leverage: Complete Guide for Traders

In the fast-paced world of intraday and positional trading, understanding margin and leverage is crucial. one of India’s top discount brokers, offers flexible margin options across equity, currency, and derivatives. This updated guide helps you navigate 5paisa margin requirements and leverage benefits for better trading decisions.

What is Margin or Leverage in Trading?

Margin or leverage allows traders to take larger positions by borrowing funds from the broker. While this amplifies potential profits, it also increases the risk of losses. provides leverage ranging from 3x to 12x for intraday trading and up to 3.5x for overnight delivery trades.

Risk Warning for Intraday Traders

Short-selling using margin is risky. If your net account balance falls below a threshold, 5paisa will trigger an automatic forced square-off. It’s important to:

- Monitor your positions regularly

- Maintain minimum margin balance

- Avoid over-leveraging in volatile markets

5paisa Margin / Leverage Overview

| Trading Segment | Leverage / Margin Offered |

|---|---|

| Equity Intraday | Up to 3x – 12x |

| Equity Delivery | Up to 3.5x (overnight) |

| Equity Futures | Up to 2x |

| Equity Options (Short Sell) | Up to 2x |

| Equity Options (Buy) | No margin (100% premium required) |

| Currency Futures | Up to 2x (Intraday) |

| Currency Options | Up to 2x (Intraday) |

| Commodities | Not Available ❌ |

📌 Important Tips Before Using Margin

- Always check live margin requirements on Margin Calculator.

- Use stop-loss orders to protect against sudden volatility.

- Track your margin usage daily to avoid forced liquidation.

Why Choose 5paisa for Margin Trading?

Here’s why 5paisa is a strong choice for leveraged traders:

- Transparent margin policy

- No hidden charges 🚫

- Advanced trading platforms: mobile, web, and desktop

- Instant margin reports and alerts

Wait! Looking for Best Demat Account

FREE Investing in Stocks & Mutual Funds with No 1 broker in India!!

+1 Crore Happy Customers

Zero Brokerage on Equity Delivery Trades

Flat ₹20 or 0.03% (whichever is lower) for Intraday and F&O

Trade with the best platforms and tools

📋5paisa Account Opening Fees & AMC Charges

Thinking of opening a Demat and trading account with 5paisa? Here’s the latest update for 5paisa account opening charges and Annual Maintenance Charges (AMC). offer one of the most cost-effective account setups among India’s top discount brokers.

5paisa Account Opening Charges at a Glance

Offers competitive pricing for new investors and traders. Below is a detailed table showing the current charges:

| Service | Fees |

|---|---|

| Trading Account Opening Charges | ₹650 (one-time) |

| Trading Account AMC | Free for lifetime 🎉 |

| Demat Account Opening Charges | Free ✅ |

| Demat Account AMC | Free for 1st year ₹400/year from 2nd year onwards |

| Commodity Account Charges | ₹0 |

| DP Services | Yes, Available ✔️ |

Key Benefits

- No hidden fees or surprise AMC charges ❌

- Free Demat account opening offer for new users

- First-year AMC waiver helps beginners save more

- All-in-one account for equity, mutual funds, and insurance

- DP services included for safe depository transactions

How to Open a 5paisa Account Online

Follow these steps to open your account in under 10 minutes:

- Visit the official website: www.5paisa.com

- Fill in your mobile number and verify OTP

- Upload PAN, Aadhaar, and bank details

- Complete in-person verification (IPV)

- Sign digitally using Aadhaar e-sign

Trust

5paisa has been in business for more than 12 years and has received industry accreditation for its trading platform, investment offerings, and trading tools, Customer support, Customer complaints management.

- 17000 Cr.+ Daily Turnover: Fastest growing online stock broker in India

- 175000+ Clients: Positioned among Top 20 broker in active customers

- 400 Cr+ Capitalization: Only discount broker in India Listed as a public limited.

- Awards: Awarded as the Emerging Brand Excellence in BFSI of the year 2018.

- 2 Million App Downloads: Fast to reach this milestone in the discounted brokerage of India.

- 500 Cr+Assets Management: A trusted brand for bringing value to your investments.

💰5paisa Brokerage Transparency & Other Charges

Choosing a broker with transparent fee structures is essential for cost-effective trading. Stands out by offering a highly transparent, flat-fee model along with clear disclosures on additional charges. Here’s an in-depth look at 5paisa brokerage fees, DP charges, government levies, and transaction-related costs.

5paisa Transaction Charges Overview

Below is a detailed breakdown of trading-related fees across various segments:

| Segment | Transaction Charges |

|---|---|

| Equity Intraday | 0.00325% or ₹325 per crore |

| Equity Delivery | 0.00325% or ₹325 per crore |

| Equity Futures | 0.0019% or ₹190 per crore |

| Equity Options | 0.05% or ₹5000 per crore |

| Currency Futures | 0.0011% or ₹110 per crore |

| Currency Options | 0.04% or ₹4000 per crore |

| Commodity Trading | Not Available ❌ |

Other Applicable Charges

| Type of Charge | Fee |

|---|---|

| Annual Maintenance Charges (AMC) | ₹400/year (1st year FREE 🎉) |

| DP Transaction Fee | ₹25 per debit transaction |

| Offline Order Placement | ₹100 per call (No order limit) |

| SEBI Charges | ₹15 per crore |

| GST | 18% on Brokerage + Transaction charges |

| Stamp Duty | As per client’s state regulations 🏛️ |

Why This Transparency Matters for Traders

Here’s why 5paisa’s clearly defined fee structure is a big plus:

- No hidden charges or surprise deductions

- Low-cost DP and AMC charges reduce long-term expenses

- Government taxes and regulatory fees disclosed upfront

- Clarity on charges helps you better calculate your net profit

Conclusion: 5paisa Fee Structure is Trader-Friendly

For active traders and long-term investors, Offers one of the most transparent pricing models in India’s discount broking segment. From minimal brokerage to clear DP charges and upfront taxes, every fee is listed and explained—making it easier for you to plan your trades wisely and beyond. ✅

📄 5paisa Reporting & Analytics Tools

Provides a complete suite of reporting tools and online trade reports to help traders and investors track their portfolio performance with ease. Whether you’re an active trader or a long-term investor, having access to real-time trade insights and reports is essential for making data-driven decisions.

Key Reporting Features

All reporting services are integrated into the 5paisa mobile app and web platform, giving users real-time access to their trading activity, profit and loss statements, and contract notes.

| Report Type | Availability |

|---|---|

| Trade Online Reports | Yes, Available ✔️ |

| PNL (Profit & Loss) Reports | Yes, Available ✔️ |

| Online Contract Notes | Yes, Available ✔️ |

Benefits of 5paisa’s Online Reporting System

- Track trades and portfolio performance in real-time

- Download historical contract notes and trade summaries

- View P&L statements for tax filing and portfolio review

- Access reports from anywhere using the app or website

- No additional charges for report access 📈

Additional Insights

Offers automated tax-ready reports, helping investors save time during ITR filing. These features are especially helpful for traders looking for clarity in tracking short-term vs long-term gains, turnover, and tax obligations.

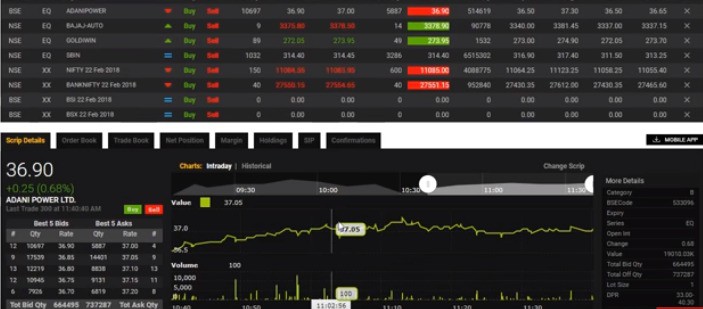

🖥️ 5paisa Trading Platforms & Tools

Offers powerful trading platforms designed for all levels of traders and investors. Whether you’re using a mobile app, desktop software, or browser, 5paisa’s TradeStation suite provides a seamless and fast experience for executing trades, viewing charts, or managing your portfolio.

📱 Mobile & Desktop Trading Platforms

Once you log in to platform, you’re greeted with a clean, intuitive dashboard that makes navigation and trading quick and user-friendly. The trading tiles on the home screen are easy to use, providing quick access to watchlists, holdings, and order windows.

| Platform | Availability |

|---|---|

| Web-Based Platform | www.5paisa.com ✔️ |

| Desktop Platform (Windows) | TradeStation ✔️ |

| Mobile App | Mobile App (Android & iOS) ✔️ |

📈 Charting Tools & Technical Analysis

Charting features are robust and impressive. With over 160 indicators and 20+ drawing tools, users can perform deep technical analysis with ease. Time frames range from 1 minute to daily, allowing both intraday and long-term traders to benefit.

| Feature | Details |

|---|---|

| Technical Indicators | 166+ (MACD, RSI, MFI, Bollinger Bands, EMA, SMA) |

| Drawing Tools | 22+ (Trendlines, Fibonacci, Pitchfork, etc.) |

| Option Chain Columns | 26 columns with advanced filtering |

| Watchlist Fields | 91 customizable fields |

| Intraday Charts | Yes, Available ✔️ |

| Daily Charts (EOD) | Yes, Available ✔️ |

| Backtesting / Coding | Not Available ❌ |

Platform Highlights

- Simple login process and modern user interface

- Cross-device compatibility: Desktop, Web, Mobile

- High-speed execution for intraday trades

- Advanced charts powered by TradingView

- No account balance requirement to access full features

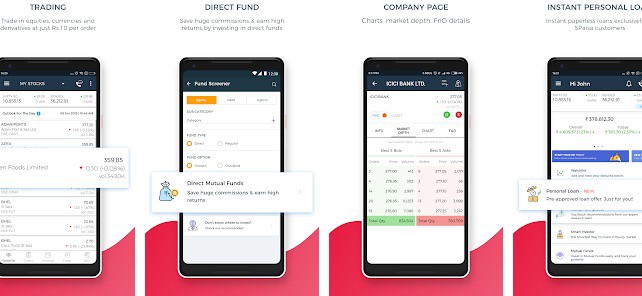

📱 5paisa Mobile Trading Application Review

5paisa’s mobile trading app is available on all major platforms, including Android and iOS smartphones and tablets. Regardless of your device, the user experience remains consistent, smooth, and enjoyable, making trading on the go easy and efficient.

Why Choose 5paisa Mobile App?

- Cleanly designed with an intuitive interface

- Bug-free ensuring smooth operation without crashes

- Feature-rich for managing your entire investment portfolio

The app allows investors to easily:

- View and manage portfolio holdings

- Customize and track multiple market watchlists

- Access real-time stock quotes and charts

- Analyze stocks using 25+ technical indicators

- Place trades instantly with live streaming data

Trading Platform & Demo Availability

| Platform / Feature | Availability |

|---|---|

| Windows Desktop Platform | Yes, Available ✔️ |

| Mac Desktop Platform | No, Not Available ❌ |

| Web Trading URL | Yes, Available ✔️ (5paisa Homepage) |

| Mobile Site | Yes, Available ✔️ |

| Mobile Trading Application | Yes, Available ✔️ |

| Mobile App Demo | Yes, Available ✔️ |

| Android / iOS Mobile App | Yes, Both Available ✔️ |

Education

This platform offers beginner-friendly stock market education with well-structured, easy-to-understand content. Users can sort material by topic, format, or course progress.

✅5paisa Support and Trading Tools

When choosing a discount broker, customer support and trading tools play a vital role in enhancing your trading experience. Offers a variety of useful resources and tools to assist investors and traders.

Why 5paisa Support Tools Matter?

Emphasis on educational content and market research equips traders with the knowledge needed to navigate volatile markets confidently. While some advanced features like a brokerage calculator and trailing stoploss are missing, the available tools are quite helpful for both beginners and experienced traders.

| Support / Tool | Availability |

|---|---|

| Research & Tips | Yes, Available ✔️ |

| Brokerage Calculator | No, Not Available ❌ |

| Span Margin Calculator | Yes, Available ✔️ |

| Trailing Stoploss | No, Not Available ❌ |

| Training & Education (Blogs, Articles) | Yes, Available ✔️ |

🔍5paisa Useful Trading Features

When selecting an online broker, the availability of useful trading features can significantly impact your trading experience. Here’s a detailed review of the key features offered, helping traders understand what to expect from this popular discount broker.

Summary Table: 5paisa Useful Trading Features

| Feature | Availability |

|---|---|

| 3-in-1 Account (Bank + Trading + Demat) | No ❌ |

| Instant Fund Withdrawal | No ❌ |

| Relationship Managers (RM) | No ❌ |

| Charts & Technical Analysis | Yes ✔️ |

| Algo Trading / Trading Robots | No ❌ |

| Mobile SMS Alerts | Yes ✔️ |

| Online Demo Account | Yes ✔️ |

| Online Portfolio Management | No ❌ |

| Margin for Future Trading | Yes ✔️ |

| Combined Records for Equity & Commodity | No ❌ |

| Intraday Square-off Timing | 3:10 PM 🕒 |

| NRI Trading Facility | Yes ✔️ |

| Extra Features | Available on request |

Additional Notes on 5paisa Trading Features

Offers solid charting capabilities and mobile SMS alerts that keep traders informed on the go. The availability of an online demo account is excellent for beginners to practice trading without risk.

However, it lacks several premium features such as 3-in-1 account integration, instant fund withdrawals, relationship managers, and algo trading, which might be important for advanced traders.

The intraday square-off time at 3:10 PM is standard among Indian brokers, so plan your trades accordingly.

💼5paisa Investment Services & Available Options

Popular discount broker offering a variety of investment services and options for traders and investors in India. Here’s a detailed look at what 5paisa provides, helping you choose the right platform for your investment needs.

5paisa Investment Services Summary Table

| Investment Option | Availability |

|---|---|

| Equity Cash, Futures & Options | Yes ✔️ |

| Currency Derivatives (Forex Trading) | Yes ✔️ |

| Commodity Trading | No ❌ |

| Online IPO Requests | No ❌ |

| Mutual Funds (MF) | Yes ✔️ |

| Bonds / Negotiable Certificate of Deposit (NCD) | Yes ✔️ |

| Exchange-Traded Funds (ETF) | Yes ✔️ |

| Banking Services | No ❌ |

| Direct Insurance | Yes ✔️ |

| Forex Investment (Long-term Forex Assets) | No ❌ |

| Mutual Fund SIP Investments | Yes ✔️ |

| Portfolio Management Services (PMS) | Yes ✔️ |

| Other Options | Available on request |

💰Banking at 5paisa: Fund Add & Withdrawal Process

Managing your funds seamlessly is crucial for smooth trading. offers a variety of convenient methods to add and withdraw funds, making banking easy for all investors.

How to Add Funds to Your 5paisa Account

- Cheque Deposit: You can add funds using traditional cheque deposits.

- Online Bank Transfer: Supports IMPS, NEFT, RTGS for instant and secure transfers.

- UPI Payments: Add funds quickly using Unified Payments Interface (UPI).

- Net-Banking: Seamless transfer via your bank’s internet banking portal.

- Payment Gateway: Use debit/credit cards or other payment gateways supported.

Withdrawal (Payout) Process at 5paisa

- Withdrawal Method: Funds are withdrawn through direct bank transfer to your linked bank account.

- Payout Processing Time: Usually within 24 hours on working days ⏳.

Linked Banks & Transaction Charges

Supports fund credit/debit from approximately 23 major banks. A nominal charge of ₹9 per transaction applies for fund transfers.

| Banking Feature | Details |

|---|---|

| Fund Add Methods | Cheque, IMPS, NEFT, RTGS, UPI, Net-Banking, Payment Gateway |

| Withdrawal Method | Bank Transfer |

| Payout Time | Within 24 Hours (Working Days) |

| Linked Banks | Approx. 23 Banks Supported |

| Transaction Charges | ₹9 per transaction |

Tips for Smooth Fund Transfers at 5paisa

- Ensure your bank account is correctly linked to your 5paisa trading account to avoid transfer delays.

- Use IMPS or UPI for faster fund additions, especially during trading hours.

- Keep track of transaction charges to manage your costs effectively.

📈5paisa Trading Order Types Explained

Understanding the various trading order types is essential for effective trading and risk management. Offers a wide range of order types to suit different trading styles and strategies.

Summary Table of 5paisa Trading Order Types

| Order Type | Availability | Description |

|---|---|---|

| Cash N Carry (CNC) | ✔ Available | Delivery-based equity trading for long-term investors |

| Margin Intraday Square Off (MIS) | ✔ Available | Intraday trading with leverage and mandatory square-off |

| Normal (NRML) | ✔ Available | Position trading without leverage in futures and options |

| Cover Order | ✔ Available | Intraday order with predefined stop loss |

| Bracket Order | ✔ Available | Intraday order with stop loss & target profit |

| Good Till Cancelled (GTC) | ✔ Available | Order active until execution or manual cancellation |

| Buy Today Sell Tomorrow (BTST) | ❓ No Information | Currently no detailed info available |

| Sell Today Buy Tomorrow (STBT) | ❓ No Information | Currently no detailed info available |

| After Market Order (AMO) | ✖ Not Available | After market order is not supported. |

Key Takeaways for Traders Using 5paisa

- Covers all basic and advanced intraday order types suitable for most trading strategies.

- Risk management is enhanced by orders like Cover and Bracket Orders.

- Traders looking for After Market Order (AMO) functionality may need to explore other brokers.

📊5paisa Investment Advice: Tips, Research & Reports for Smart Investors

When it comes to making informed investment decisions, Offers a variety of advisory services and research reports designed to help traders and investors succeed in the stock market.

Summary Table of 5paisa Investment Advice Services

| Service | Availability | Description |

|---|---|---|

| Equity Research | ✔ Available | Comprehensive stock market analysis and research |

| Mutual Fund Research | ❓ No Info | Information currently unavailable |

| ETF Research | ✖ Not Available | No research on Exchange-Traded Funds |

| Daily Report | ✔ Available | Daily market update reports for investors |

| Free Tips & Advisory | ✔ Available | Expert investment tips and advisory at no cost |

| Company Result Analysis | ✔ Available | Detailed quarterly and annual result reviews |

| News & Alerts | ✔ Available | Real-time market news and notifications |

Why Choose 5paisa for Investment Advice?

- Access to reliable and updated equity research reports.

- Free expert tips helping beginners and seasoned traders alike.

- Timely news and alerts to capitalize on market opportunities.

- Comprehensive company result analysis for better stock selection.

📞5paisa Customer Care Services & Support

This broker offers strong support via email and phone, with a dedicated compliance officer for complaints. Based in Mumbai, it ensures quick responses and an easy, paperless account opening process—blending affordability with quality service.

- Head Office Location: Mumbai (Sun Infotech Park, Wagle Estate, Thane)

- Customer Complaints Support: Direct contact with Compliance Officer Mr. Nirav Shah (8976689766, [email protected])

- Paperless Account Opening: Seamless and quick digital process

5paisa Customer Support Channels & Availability

| Support Type | Availability | Details |

|---|---|---|

| 24/7 Customer Care Service | ✖ Not Available | Support during business hours only |

| Email Support | ✔ Available | [email protected] for general queries |

| Live Chat Online | ✖ Not Available | No live chat support currently |

| Phone Support | ✔ Available | Contact at 8976689766 |

| Toll-Free Number | ✖ Not Available | No toll-free customer care number |

| Branch Support | ✖ Not Available | No physical branch support |

| Complaint Emails | ✔ Available | [email protected] [email protected] [email protected] |

Additional Customer Support Features

- Educational blog with market insights and trading tips ✔

- Paperless and hassle-free account opening process ✔

- Compliance officer available for escalation and complaints ✔

⭐Review & Ratings

Looking for an updated broker review? Here’s a clear analysis based on user feedback, platform performance, and services offered.

✅ Why Ratings Matter

Before choosing any online stock broker, it’s important to evaluate real user ratings and expert reviews. Here’s how 5paisa performs in different aspects of trading and customer experience.

5paisa User Review Summary

| Category | Ratings (Out of 5) |

|---|---|

| Customer Experience | 4.5 ⭐ |

| Trading Platform / Mobile App | 4.9 ⭐ |

| Brokerage & Charges | 5.0 ⭐ |

| Services & Features | 4.5 ⭐ |

| Fund Add / Withdrawal | 5.0 ⭐ |

| Overall User Rating | 4.7 / 5 ★★★★★ |

| Review Count | 845 Reviews |

🔑 Key Takeaways

- High-rated mobile app with advanced features 📱

- Strong user satisfaction in fund withdrawal process 💰

- Excellent brokerage structure for budget-conscious traders ✅

- Customer support and trading experience rated positively 📞

📑SEBI Registration & Compliance Details

As a trusted and fully compliant discount broker in India, 5paisa Capital Ltd is registered with multiple regulatory authorities including SEBI, NSE, BSE, AMFI, and CDSL. Below are the updated legal and regulatory registration details to ensure full transparency and build investor confidence.

Regulatory Registration Details

| Registration Type | Details |

|---|---|

| SEBI Registration Number | INZ000010231 |

| SEBI Research Analyst (RA) Registration | INH000004680 |

| SEBI Depository Participant Regn. | IN-DP-192-2016 |

| AMFI Registration No. (ARN) | ARN-104096 |

| CIN (Corporate Identity Number) | L67190MH2007PLC289249 |

| NSE Member ID | 14300 |

| BSE Clearing No. | 6363 |

Why These Registrations Matter

- SEBI: Ensures legal compliance and investor protection 🛡️

- AMFI: Authorization to distribute mutual fund products 💼

- CIN: Company registration identifier under Ministry of Corporate Affairs 🏢

- NSE/BSE Membership: Legally allows trading on Indian stock exchanges 📈

Comprehensive registration with all key regulatory bodies highlights its legitimacy and commitment to maintaining ethical financial practices. Whether you’re investing in stocks, mutual funds, or derivatives, your transactions remain secure and regulated.

5paisa Frequently Asked Questions

What Is Intraday Brokerage charges In 5Paisa Capital?

5Paisa charges Rs.20 per order for all segments like Stocks, Commodity & Currency.

How Many People Using 5Paisa Capital?

5Paisa has More than 9,00,000+ active customer.

What Are Annual Maintenance Charges For Equity, Commodity, Currency And F&O In 5Paisa Capital?

5Paisa charged Rs.0 for Trading & Rs. 540 per yearly for Demat Annual Maintenance Charges.

What Are Account Opening Charges For Equity, Commodity, Currency And FNO In 5Paisa Capital?

Rs.300 of trading & Rs.0 Demat account opening charges.

Does 5Paisa Capital Provide 3 In 1 Account?

No, 5Paisa is a discount full-service stock broker & offer only offer Trading + Demat account.

Is Any Screener Available in 5Paisa Capital?

Currently 5Paisa Capital do not offer screener.

Is Algo Trading Facility Is Available With 5Paisa Capital?

Yes, Algo trading facility now available with 5Paisa.

Data Analysis Is Available With 5Paisa Capital?

Yes, 5paisa provides analysis market data with also trading platforms.

How Many Days Are Required To Credit Fund Into My Account In 5Paisa Capital?

Fund withdrawal usually takes 1 working day to credit fund.

Does Investment In Mutual Funds Allowed & charges In 5Paisa Capital?

Mutual funds investments are allowed in 5Paisa & Rs.0 brokerage charges for MF investments.

Does 5Paisa Capital provide Research & Advisory, Tips?

Yes, 5paisa is full-service broker & they offer Research, Advisory.

Do i Apply IPO Through 5Paisa Capital?

Yes, Customer can apply IPO in 5Paisa Capital and IPO application process is very easy.

Take A Look