Some investors do not invest in stocks. But they find it easy to invest in mutual funds. This is because if the investor does not have a good knowledge of the stock market and does not have time to study the stock market, then all classes prefer to invest in mutual funds. As the value of the portfolio increases. As such, the unit price of the mutual fund rises. Every mutual fund has a different investment scheme. Some invest in stocks, some in government bonds and some in both.

What is Mutual Funds?

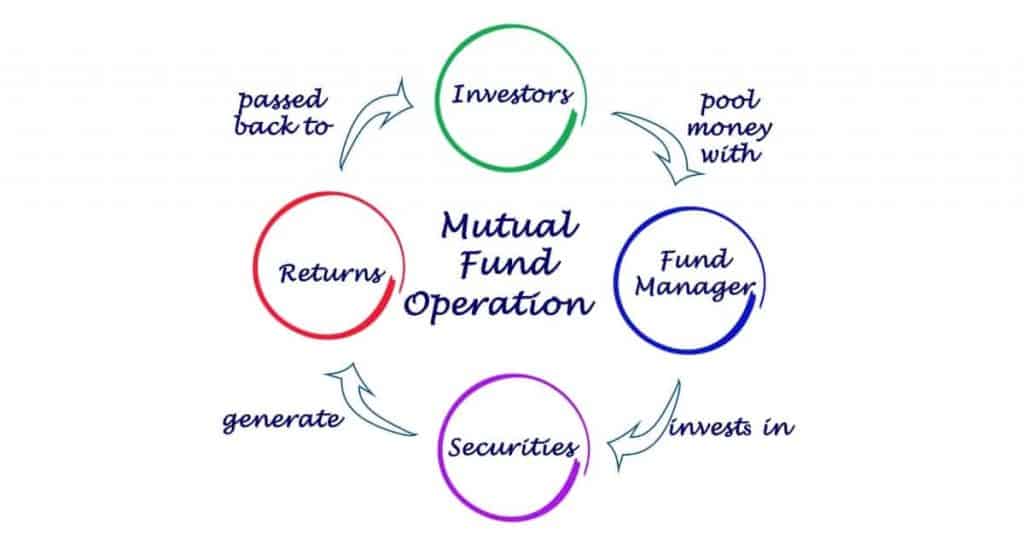

A mutual fund is a trust. (This trust is registered through the Charity Commission of Trusts) This organization collects money from the people and invests that money in various securities. The investment was in line with the objective of the scheme. In other words, mutual is a way of accumulating the capital of the common people.

A fund that invests only in government securities has stable earnings. Funds that invest in stocks fluctuate in the price of their units.

Advantage of Mutual Funds Over Equity Stock

When it comes time to invest. Mutual funds or the stock market are the two options that come to mind. Today we will see why investing in mutual funds is a better option for you than investing in the stock market.

Stock market investing is called direct investment because you invest by opening a Demat account. Mutual fund investments are called indirect investments, because mutual fund managers are investing for you. Many stock brokers currently offer online mutual fund purchasing.

1.Diversification

Mutual funds invest capital in an expanded form. They first know the full details of the company they are investing in, such as how profitable that company is. At the same time, they compare a company in one sector with another in the same sector and find and invest in 5 or 7 good companies in that sector. Although the prices of two or three of these companies have gone down, the net assets of mutual funds have not changed much.

2. Systematic Investment Plan (SIP)

Systematic planning is one of the popular schemes for investment door. This is because you have to invest in it regularly at regular intervals. The investment in this scheme has to be made every one month or every three months. Normally, you have to invest at least Rs 5,000 initially and then pay Rs 1,000 per month.

3. Make an easy investment and exit easily

Mutual funds can also make a purchase by filling out a form. And you can get out of them by filling out another form. Mutual funds do not have a system where you have to register with a stockbroker and open a demat account when you want to buy shares.

4. Professional Management

Mutual fund institutions have the participation of all highly educated persons like engineers, MBAs, CAs etc. who have good experience in this field.

They constantly focus on the international and local markets and make necessary changes to the portfolio from time to time.

Mutual Funds Mode of Action

Net Asset Value (NAV)

A mutual fund is a fund that is accumulated by many people by depositing more or less amount. Which is invested in the stock market or in government securities? The funds earned from it are called mutual funds. Units are given to those who invest in mutual funds. (Investors in the company get shares.)

The unit price fluctuates according to the amount of money left over from the earnings on the money invested, which we call the net asset value.

E.g. A mutual fund raised Rs.1 lakh by selling 10,000 units at a price of Rs 10. After deducting expenses and management fees, he invested the rest of the funds in shares or government securities. Returns earned by this fund is Rs.10, 000 after a month. Here the revised NAV per unit is Rs 11 for this fund.

Different Schemes Available Under Mutual Funds

Currently there are many funds available in our country. And their various schemes are also available. Investors invest in mutual funds according to their capital and their risk-bearing capacity.

Growth Fund

The fund has the benefit of an increase in the share price and the fund is invested only in the shares of the company which provides the highgrowth. It works even if the company does not pay dividends.

Income Fund

If you invest in this funds, you get about twelve to fifteen percent profit. The income from this usually starts in the first year. Some funds pay time dividends three or four times a year.

Money Market Liquid Fund

This fund has low risk and low income compared to other funds. Its average income rate is slightly higher than the bank’s fixed deposit.

Gilt Fund

If the investor wants to invest without taking any risk, he invests in this fund because this fund only invests in government securities.

ELSS (Equity Link Saving Scheme)

For those who have a high income, this plan is very beneficial as its locking period is three years. If an investor sells his units early for some reason, he does not get income tax benefit. If you want to keep the investment for a longer period, you can keep it. The risk is higher than the above point. The benefit is also higher. The estimated benefit is 22 to 28%.

Index Mutual Funds

The gain or loss in this fund is based on the index. But for investors who are willing to take risks, this fund is a boon. The Nifty rose by 7,000 points in Apr-2020 to Apr-2021 after covid-19 Impact. This gave him an unimaginable profit. It is also true that due to the major events like pandemic, election, war, natural disasters, Fraud events like Ketan Parekh, At that time, the index had come down and investors had to suffer a lot.

Also, in a fund, when the index is stable, the profit margin is very low.

Conclusion

No stock market related investments could be termed safe with certainty, as they are inherently risky. However, different funds have different risk profile, which is stated in its objective. Funds which categorize themselves as low risk, invest generally in debt, which is less risky than equity

Anyway, as mutual funds have access to services of professional Fund Managers, they are always safer than direct investment in the stock markets.

Take a Look