BMA Wealth Creators Reviews: BMA Wealth Creators Ltd is a part of BMA Group. It is a financial service providing company and they have more than 15 years of experiences in the same industry. BMA Wealth Creators Ltd has a huge presence in across all major cities in India with more than 40+ branches and 7000+ partners most important thing is they have More than 10,00,000+ Customers.

Now they are operating globally also. All segments like Equity, Commodity, Currency, Derivatives, Mutual Fund, and Insurances are available for investments and online trading. BMA is a member of NSE, BSE, MCX, and NCDEX. They provide high-end research on the basis of both technical and fundamental analysis.

Key Features:

- Dedicated Expert Team.

- Good Quality Research and Advisory

- Vast presence in India.

- Online Mutual Fund.

| Website. | www.bmawc.com |

| Demat Account. | CSDL. |

| Trading Exchanges. | NSE, BSE, MCX-SX, MCX & NCDEX. |

| Broker Type. | Full-Service Broker. |

BMA Wealth Creators Reviews for Account Opening Charges.

| Trading Account. | Not Available. |

| Demat account. | Rs.1000. |

| Commodity Account. | Rs.0. |

| Trading Annual maintenance charges (AMC). | Rs.350/per year. |

BMA Wealth Creators Reviews for Margins or Leverage.

| SEGMENT. | BROKERAGE. |

| Equity (Intraday). | Upfront Brokerage: 0.03%to 0.01% for Intraday. |

| Equity (Delivery). | Upfront Brokerage: 0.3% to 0.1% for Delivery. |

| Equity Futures. | Upfront Brokerage: 0.03% to 0.01% of Turnover. |

| Equity Options. | Upfront Brokerage: Rs 50/lot to Rs 10/lot. |

| Currency Futures. | Upfront Brokerage: 0.03% to 0.01% of Turnover. |

| Currency Options. | Upfront Brokerage: Rs 50/lot to Rs 10/lot. |

| Commodity. | Upfront Brokerage: 0.03% to 0.01% of Turnover. |

Margins or Leverage.

| SEGMENT. | MARGINS. |

| Equity (Intraday). | Up to 10 times Intraday. |

| Equity (Delivery). | up to 2 times for Delivery @interest. |

| Equity Futures. | Up to 4 times for Intraday. |

| Equity Options. | Buying no Leverage, for Shorting up to 4 times. |

| Currency Futures. | Buying no leverage, for Shorting up to 2 times. |

| Currency Options. | Up to 2 times for Intraday. |

| Commodity. | Up to 4 times for Intraday. |

Trading Platforms or Software.

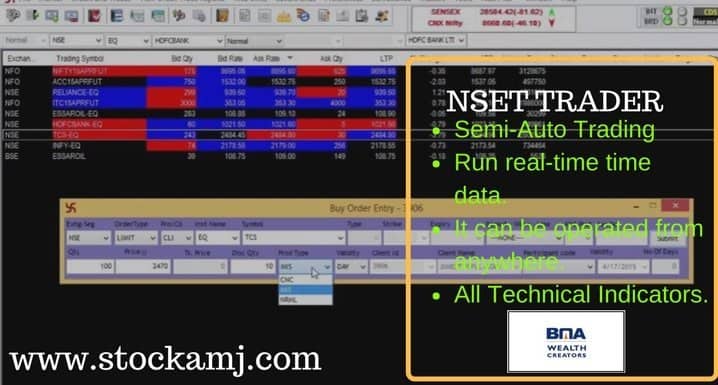

| Trading Platform or Software. | NEST Trader. |

| Web-based. ( BMA Trade Login ) | Client Login. |

| Mobile Application. | BMA m Trade |

Nest Trader

- It is software for trading. Nest trader is developed by Omnesys technologies. There are so many trading features like a market watch, order book, trade book, online chart etc.

- BMA wealth creators software download. for online BMA connect you just need desktop want the internet connection. For bma nest trader setup pls contact customer care.

BMA m Trade

- Official BMA wealth creators Android mobile application or mobile trading software (BMA mobile App).

- The client can download from google play store.*device requirements: Android OS 4.4 and above. More than 30000+ downloads with an average 3.0-star rating for BMA m trade reviews from 208 users.

BMA Wealth Creators Reviews for Some Useful Services.

| Online Trade Reports. | YES. |

| Online PNL Reports. | YES. |

| Intraday Chart Facility. | 22 Days on NEST. |

| End of Day Chart Facility. | 10 Years on NEST. |

| 3 in 1 Account. | NO. |

| Instant Fund withdrawal. | NO. |

| Relationship Managers. | YES. |

Wait! Looking for Best Demat Account

FREE Investing in Stocks & Mutual Funds with No 1 broker in India!!

+1 Crore Happy Customers

Zero Brokerage on Equity Delivery Trades

Flat ₹20 or 0.03% (whichever is lower) for Intraday and F&O

Trade with the best platforms and tools

Useful Details.

| Price (Broker Type). | Percentage Based. |

| Headquarters City (Head Office). | Kolkata(West Bengal). |

| Total Branches (Presence). | 42 branches. |

| Research & Tips. | Yes, Research Provided. |

| Total Experience in Broking. | 11 Years of experience. |

| Year of Incorporation. | 2004. |

Client Info & NRI Account opining Regulations.

| Current Active Client Base? | More Than 20,000. |

| NRI Account Opening Allowed Or Not. | YES, It is Allowed. |

BMA Wealth Creators Reviews for Fund Transfers Service.

| Number of banks linked to account. | 2+ |

| Mode of payment (Withdraw &Deposit). | online(NSE NOW), NEFT/RTGS. |

| Fund Payin processing time. | Instant by payment Gateway. |

| Fund Payout processed (Working Days). | 1 Day. |

Turnover & Other Charges.

| Equity (Cash & Delivery) Turnover charges. | 0.0049% of Turnover. |

| Equity Futures Turnover charges. | 0.0049% of Turnover. |

| Equity Options Turnover charges. | 0.071% of Turnover. |

| Currency Futures Turnover charges. | NA. |

| Currency Options Turnover charges. | NA. |

| Commodities Turnover charges. | 0.0035%. |

| Dial & Trade charges. | Rs.0. |

| DP Transaction charge. | Rs 15 or 0.03% whichever is higher. |

BMA Wealth Creators Reviews for Support & Tools Available.

| Brokerage calculator. | Not Available. |

| Margin Calculator. | Not Available. |

| Bracket orders & Trailing stoploss. | Not Available. |

| Cover order. | YES. |

| User guide & remote end support. | Not Available. |

Reports & Confirmation.

| Contract notes on Email. | Yes (Register Email ID). |

| Contract notes online. | Yes (Register Email ID). |

| Periodical statement on Email. | Yes (Register Email ID). |

| Trade confirmation on Email. | Yes (Register Email ID). |

| Trade confirmation on SMS. | Yes. |

Additional Features.

| Charting (Intraday & EOD). | YES. |

| Coding or Backtesting (Algo Trading). | Not Available. |

| Referral program (Affiliate). | Not Available. |

| Training & Education. | Not Available. |

| Online trading community. | Not Available. |

BMA Wealth Creators Reviews for Customer Care Services.

| Contact Details. | Head Office. 29/5A, Dr, Ambedkar Sarani Viswakarma Building, Tower – IITopsia Road Kolkata – 700046 |

| Call. | Customer Care. Tel No: 033 – 40110099 |

| Email. | [email protected] |

| Complaints Or Grievances. | [email protected] |

Note:

- For any complaints pls write to us on [email protected] or comments in below reviews section.

- BMA has a presence in more than 15 states of India with 42+ branches and head office located in Kolkata while corporate office locates Mumbai.

- Just call 1860-3000-1099 and connect to customer care number.

Advantage and Disadvantage.

Advantages:

- Pan India Presence

- Very Good customer care.

- Research and Advisory

- Online Mutual Fund.

Disadvantages:

- Brokerage calculator not available on the website.

- No live chat.

- Low Exposure

BMA Wealth Creators Ezeewill.

Features:

- Easy automated Online Process for Will Creation.

- Assured confidentiality, the reliability of your Personal Data.

- Will drafted by experienced professional Lawyers.

- Help you Capture all your Assets in a Systematic manner.

- Simple & Convenient way to secure wealth distribution.

BMA Wealth Creators Review & Ratings

On the scale of 5 (0 is worst & 5 is best). Below are the review & rating for BMA Wealth Creators.

| Summary | Ratings |

|---|---|

| Customer Experience | 3.5 / 5 |

| Trading Platform / Mobile APP | 4 / 5 |

| Services | 4 / 5 |

| Brokerage Charges | 5 / 5 |

| Fund Add / Withdrawal | 5 / 5 |

| Overall Rating | 4 / 5 |

| Star Rating | ★★★★ |

| Review Counts | 980 |

Sebi Registration.

| SEBI Regn. No : NSE: INB231233132. |

| NSE FO: INF231233132. |

| NSE CD: INE231233132. |

| BSE: INB011233138. |

| NCDEX: 00523. |

| MCX: 28055. |

More Useful Article

OPEN THE DEMAT

Ok Service

I am a existing member ,seeking for clarification regarding the brokerage charge for option trading as it shows ,rs 50 to rs 10 ,actually what will be net brokerage required for buy and sell of 1 lot of a script,pl inform

PLEASE TO THE DEMANT ACCOUNT CLOSURE

Already have a account but want to know my brokerage plan

They says brokerage is between 0.3% to 0.1%. But actually they charges .5%. I bought 100 NIFTY for 64800, and the brokerage charged was 324. Now the more the brokerage the more will be 18% GST. Other charges like stamp, transaction charges are normal. In total overall charges for this buy was 427 rs. When I will sold these stocks I was charged around 450. So almost 900 rs was taken by the broker for this trade. And the agents will persuade you to execute more trades, and if you hear them your account will hit zero within no time.

For your full product demonstration and interested on your platform.